Scores of central bankers will gather in Hong Kong next month for the first major international financial event since the border fully reopened

The HKMA is keen to promote the city’s finance sector after three years of Covid-19 restrictions dimmed its lustre

Scores of central bankers from around the world will gather in Hong Kong next month for a meeting to be hosted by the Bank for International Settlements (BIS), marking the first major international financial event since the city fully reopened its border in December.

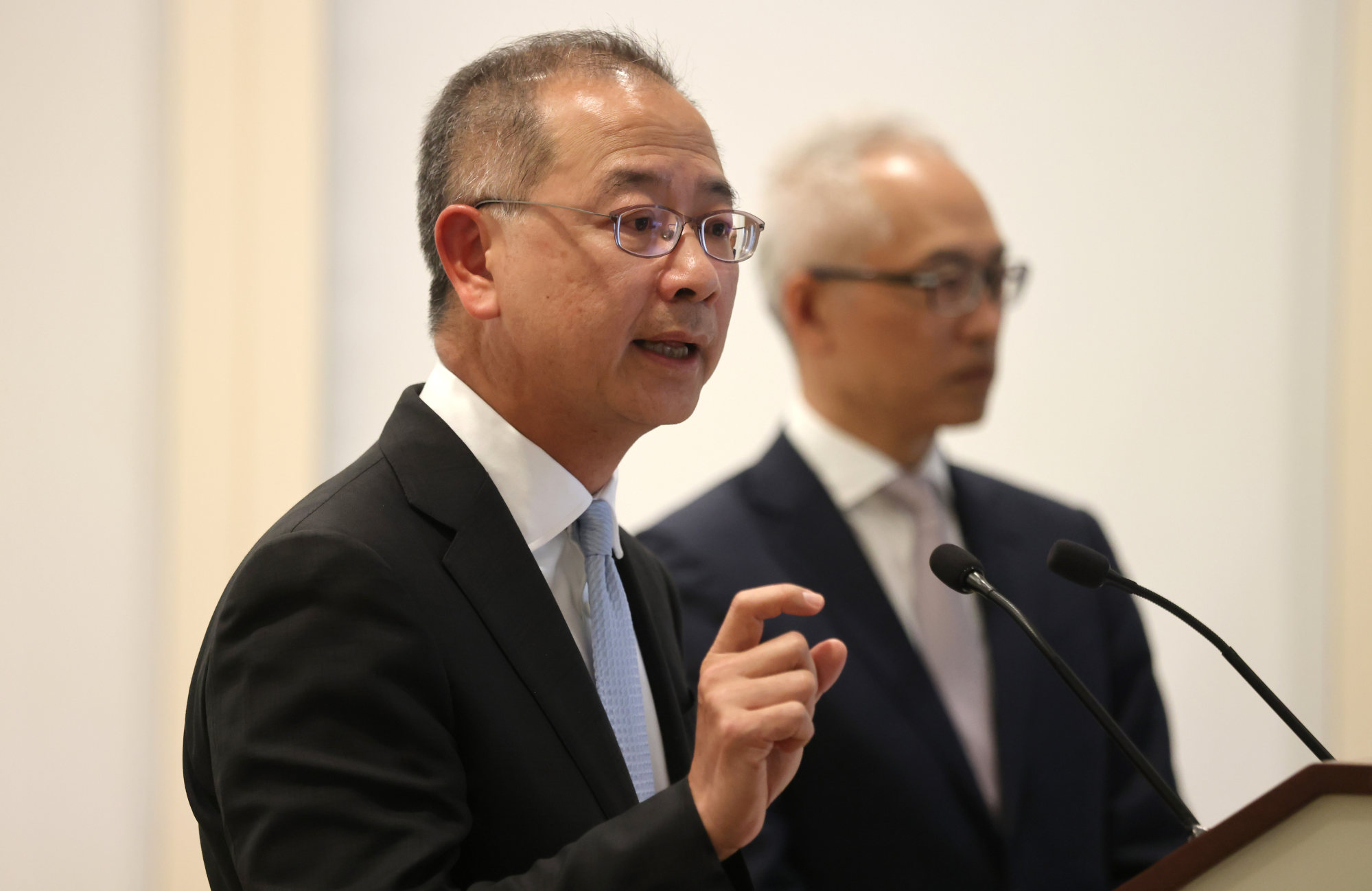

The Hong Kong Monetary Authority is getting ready for the Basel Committee on Banking Supervision meeting to be held in March, Clara Chan, acting deputy chief of the de facto central bank, told lawmakers.

“We have been preparing for the meeting of central bankers, international financial regulators and the global financial leaders. We encourage more international financial organisations to host events and seminars in Hong Kong,” Chan said during a monthly meeting of the financial affairs panel on Monday.

“The HKMA will also work with the local financial sector to visit Southeast Asia and the Middle East to exchange views with the central banks and other financial leaders this year to enhance cross-border cooperation.”

The authority is keen to use overseas roadshows to convince central banks and finance companies that it is “business as usual” in Hong Kong after three years of disruptions caused by the pandemic. The city’s reputation as a leading financial hub suffered as some of the world’s toughest restrictions prevented business travel and brought the economy to its knees.

The Basel Committee on Banking Supervision is a global standard setter for the regulation of banks and provides a forum for regular cooperation on supervisory matters. Its 45 members comprise central banks and bank supervisors from 28 jurisdictions, according to the website of the BIS.

The Basel-based BIS, known as a “bank for the central banks”, was founded in 1930 with 63 shareholding central banks. Its mission is to serve central banks in their pursuit of monetary and financial stability, and international cooperation.

It set up its Asian office in Hong Kong in 1998 and an innovation hub in 2019.

The chief executive officer of the HKMA, Eddie Yue Wai-man, told lawmakers at Monday’s meeting that the de facto central bank will host more events this year, including another financial summit in November.

It comes after the success of the Global Financial Leaders’ Investment Summit in November last year. More than 200 top financiers from around the world attended the conference, which took place after the city scrapped its hotel quarantine requirements for incoming travellers. Visitors still needed to go through three days of medical surveillance, a requirement that was abolished in December.

The border between Hong Kong and the mainland reopened on January 8.

Yue said the Exchange Fund – a war chest to defend the local currency’s peg against the US dollar – has raked in tens of billions of Hong Kong dollars’ worth of investment income in January as the markets have bounced back. Last year it reported a record loss of HK$202.4 billion (US$25.8 billion) on the back of plunging stock, bond and currency valuations.

“We have already adopted a cautious investment approach by increasing our cash holdings and short-term bills in the Exchange Fund,” Yue said.

“Despite the heavy loss last year, the Exchange Fund still has a size of over HK$4 trillion, which can support the local currency and maintain the peg. The public do not need to worry about the Exchange Fund’s losses – they should take a long-term view of the investment.”

Monday’s panel heard that the city’s total bank deposits rose 1.7 per cent last year, including a 0.7 per cent increase in Hong Kong dollar deposits. The value of loans, however, fell by 3 per cent last year, the first decline in two decades, versus a 3.8 per cent increase in 2021.

“Companies may not have had a strong appetite to borrow money last year amid the pandemic. It is expected that the border reopening between mainland China and Hong Kong will boost the economy and hence help to boost more loan demand this year,” said Arthur Yuen Kwok-hang, deputy CEO of the HKMA.

Source: SCMP